How to react – What you really need to know

Your 2020 Annual Pension Statements – is this relevant to me?

This note is for you:

- if you have a pension plan where what you can get out depends on how big your fund is;

- particularly, if you have had an annual pension statement recently;

- especially, if you are planning to take some or all of your pension fund in the next 15 years;

- definitely, if you want to make sure you don’t get nasty surprises just when it really matters.

How much you can take out of your pension and for how long will be decided by the size of your fund. Taking a few moments interest in how it performs now, gives you a better idea of how comfortably you will be able to live in the future and what actions you will need to take, and when, to protect your planned future lifestyle.

Understanding – Deciding … Acting? A timely reminder.

If you have had a statement recently you may find that your fund has fallen in value or at least not gone up as much as you would have expected over the previous 12 months.

Many of us have seen this. Most of us probably don’t need to change anything.

Some of us, however, may need to use this as a trigger to rethink what we are aiming for, and carry out some actions we possibly should have been doing anyway.

KEY POINT: You may not need to change investments buy you may need to take some simpler actions

Your 2020 pensions statement gives you a great opportunity to do this. Take a few minutes to check the basics and how you should react. Ask yourself 5 questions …

5 Questions to ask yourself

A natural reaction when we see our funds fall could be to worry and possibly to question if we are invested in the wrong funds. 5 questions to ask yourself before deciding whether to be concerned and whether to act are:

Q1. Why has my fund fallen? The 31 March 2020 snapshot

Annual pension statements which have come out recently, typically compared your fund value at 31st March 2020 against what you had 12 months previously.

March 2020 was one of the worst months in history for almost all types of investment. This was particularly true for investments designed to grow over medium to long periods such as stocks and shares (equities) and property. So looking at your fund’s investment performance just over that 12 month time period, was probably not showing it in the best light.

KEY POINT: A 31 March 2020 snapshot was at the end of a bad month

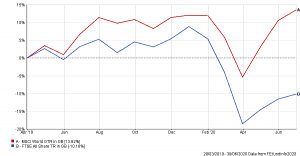

The below shows why taking a snapshot at 31st March this year was unfortunate timing and how stock market investments moved in the following 4 months.

The higher, ‘A’ red line shows the last 15 months movements in a performance measure of Global Equities which are typically a key component in ‘default investment’ strategies used by most pension scheme members. The lower, ‘B’ blue line shows the same for an index of UK Equities often another big component of default strategies.

If you are around 10 to 15 years years away from the expected retirement age your pension provider has recorded for you, and have never made your own investment decisions, the chances are your pension fund perfomance is heavily influenced by these types of investment. It is also possible that even if you are a few years away, your money could also be in these funds. It depends on the scheme and the provider and so you should really check to avoid nasty suprises.

You can clearly see on this graph how anytime around 1 April 2020 was the worst time to compare against April 2019 and this could be what your recent pension statement is showing.

Look also at what has happened since April 2020. This shows how these equity/stocks and share markets can rapidly move up or down over a few days and weeks.

Similarly you can see how, even taking March 2020 into account, investing in global equities, through a default or your own strategy, even over this short 15 month period would have been better than saving in cash or keeping ‘money under the mattress’.

So the messages are:

- Don’t be too worried about a March/April 2020 snapshot

- Do understand that these investments often have big, short term falls and rises.

- Do check where you are invested if planning to take money out in the next 5 to 10 years.

KEY POINT: Don’t be too concerned about performance over one 12 month period unless you need to access your fund soon.

To get a more in depth account of how quickly or slowly bad months have been overcome in the past, and how investing in equities has provided good long term growth, have a look at the video on investment in our Hub. You’ll see how historically, as long as you are investing for a long term and not expecting to take your money out soon, you need not be overly concerned by an isolated 12 month snapshot.

Q2. Where am I currently invested and for how long?

If you have made your own investment choices hopefully you will be fully aware where your pension funds are invested and whether you need to review them.

If like many people you haven’t made your own choice, you will be invested in the ‘default strategy’ for your scheme. Default strategies vary from scheme to scheme but generally they focus on growing your money in the long term, by taking risks and putting it mostly into equities and property until 5 to 15 years before the pension provider or trustees believe you are planning to start taking your money out. If you are not sure what their strategy for your pension funds check directly with them and in the meantime, as a quick guide, you can Click Here to review typical strategies for some of the larger pension providers.

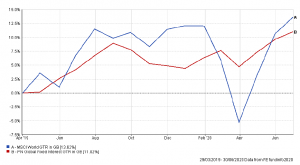

If you are within 5 to 15 years of the target retirement date your pension provider has recorded for you, their focus maybe more on protecting your fund value. You may be in lower risk investments as well as, or instead of, equity and property. For example it is possible that you are invested in Fixed Interest investments such as Corporate Bonds or Gilts. A measure of their recent performance is set out by the Global Fixed Interest ‘B’ red line below.

KEY POINT: Lower risk investments fell in March as well but have bounced back since

As the red line shows, types of Fixed Interest (lower risk investments) also lost value in February and March this year. However they didn’t fall as much as Global Equites (‘A’ blue line) and following a similar pattern, they too bounced back – albeit a less rough ride.

So if you are still at least 10 years or more from when you expect to take money out, you may be comfortable with the sharp rises and falls in short terms returns from equities.

Q3. How am I planning to take money from my plan?

If you are still 15 years or more away from taking your money you probably don’t need to concern yourself too much with this but if you are closer, you should. You essentially have three choices. You can take your money out:

- in one or more, partially taxable, lump sums,

- to create a secure lifelong annuity income,

- bit by bit as flexible, regular income known as ‘drawdown’, for as long as you, or the fund lasts – which will be in part dependent on continuing investment performance on your funds.

You may also decide on a blend of these three options and your choice should depend on a variety of personal factors.

KEY POINT: Check your pension provider is targeting the same retirement choice as you.

The important thing to ensure is that where you are invested, is targeted to how you are expecting to use your pension funds.

For example your pension provider may assume you are going to take a flexible ‘drawdown’ income and expect to leave your money invested in higher risk funds well beyond the target retirement age they have for you. If so they will invest your fund in accordance with that target.

That maybe what you are thinking as well. If however you are thinking of taking the fund as cash or converting to a secure annuity income you probably need to take some action on where you are invested.

You should decide at least 15 years out on how you will take each pension fund and make sure your investments are targeted for your choice either under the existing default strategy, or if needs be by looking at alternative strategies offered by the provider. Providers will often have off the shelf strategies targeted for: Cash, Annuity and Drawdown targets at retirement.

Q4. When am I planning to take money from my plan?

If you are not planning to take your money for several years you can afford to be relaxed about short term fluctuations in your fund value.

- Imagine if you had been planning to take your money out as one lump sum in April 2020.

- Imagine also if you were invested in equities at that point.

- Imagine that, at that time you didn’t know if the markets would bounce back soon or keep falling.

KEY POINT: Planning to take your money out soon? You should check where you are invested NOW

If in this scenario you’d decided to bite the bullet and go ahead and take your money, you could have ended up with 15 to 20% less cash than if you took your fund as a lump sum in January or deferred to July.

This highlights the importance of checking your pension funds are invested in line with when you want to start getting your money back out as well as how.

Q5. Have I told the pension provider when I plan to take my money?

All pension schemes have ‘Normal Retirement Ages’ which is typically set to 65 or State Pension Age but it’s generally possible to take money out from age 55 onwards. You are in control of this and you can change your personal normal retirement age, pension by pension, as your retirement picture becomes clearer.

It is very important to make sure your pension provider knows your intended target ages. Don’t keep them in your head.

A key reason is that it might significantly alter the way your pension funds are invested. Assuming you haven’t made your own investment choices and that you are invested in a default strategy, your pension provider will use your target retirement to determine when to start changing how you are invested and what risks they take with your money.

KEY POINT: Tell your provider when you plan to take your money out – at least 10 years beforehand

So if you planned to start taking your money from age 60 but they weren’t aware and were assuming age 65, your providers investment strategy for your money would effectively be 5 years behind your retirement plans.

You could be left in higher risk funds closer to your intended retirement age than you might be comfortable with.

Your money may not be in the right places at the right time for your future life plans.

So take a few moments to click through the above links and get more understanding on the areas you may need to consider further. By taking the time to complete this exercise you will be aware of what actions, if any, you need to be taking now.

Summary

March 2020 was a bad month for many types of investments so April 2020 pension statement snapshots were taken at an unfortunate time.

However, they do illustrate the importance of aligning your retirement thinking with your investment strategy and your providers understanding.

If you are more than 15 years from retirement and comfortable with the rises and falls associated with stockmarket investments, you can stay composed and focus on leaving your money invested for long term growth.

If you have less than 15 years to your planned retirement age, the 2020 pensions statements highlight why there are actions you may need to take. They include:

ACTIONS

- Let the provider know ‘when’ you are targeting access to your pension money.

- Decide ‘how’ you are most likely to take money from your fund – cash, annuity or drawdown at least 10 years prior to your anticipated retirement date.

- Align your ‘how’ and ‘when’ targets with your providers.

That way any short term changes in investments should be nothing more or less than expected.