What is a Lifestyle Fund?

Lifestyle funds, now often referred to as retirement target or target dated funds, are the most common type of fund used by pension schemes as a default fund. They are sometimes known as phased, protective, automatic or default switching and are designed for members who prefer not to make active fund choices over the course of their working life by automatically moving members’ funds to less risky investments as they approach retirement.

This option will have been selected by a member, employer or trustees of the pension scheme, usually when the pension was set up. Members can add or remove lifestyle switching at any time. Lifestyling involves investing in riskier assets when members have a long period before drawing their retirement benefits. As members get closer to retirement, typically 5 to 10 years before, switching from these riskier assets into less risky ones, such as cash or fixed interest, that aren’t as likely to be affected if the investment markets were to fall sharply, helps to keep the investment growth, during the period up to your retirement.

There are two main stages in lifestyle funds:

1) Growth Stage

The growth stage involves investing in riskier assets such as equities when members have a long period before withdrawing their pension funds. The aim is to accumulate as much investment growth as possible in the early years.

2) Consolidation Stage

The consolidation stage takes place in the final years before a member retires, typically in 10 or 15 years before retirement. Investments are moved from riskier assets into less risky ones, such as cash or fixed interest. This is designed to ‘lock in’ accumulated investment growth and to protect funds from volatility in the stock markets. While some providers offer specific ‘lifestyle’ funds, others will have a lifestyle option that uses their mainstream funds to achieve the same process.

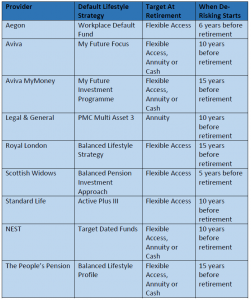

Default Lifestyle Strategies of Providers

The providers’ default strategies are:

Why do some Lifestyle Strategies need reviewing?

Over recent years, the Government has introduced a number of measures that have given members the opportunity to have greater control over their pension account. This means that they have a very wide variety of choice at the point of taking benefits out of their pension plans.

Traditionally most members purchased an annuity at retirement as it provided a guaranteed income for life. However in recent years annuity rates have substantially decreased, mainly due to low interest rates and rising life expectancy. The result of this is that flexible drawdown is the most popular option at retirement. This gives greater flexibility over income and also keeps funds invested so that there is the possibility of investment gains during retirement.

As a result of this, most providers have a default lifestyle strategy that either keeps members’ options open at retirement or specifically targets flexible drawdown.

If members are in a strategy that targets an outcome they do not consider suitable for their retirement needs they should contact their provider to discuss other options.

Attitude to risk

Attitude to risk is essentially a member’s tolerance for loss, i.e. the amount of risk a member is willing to take. This will generally be based on the member’s circumstances, investment timescale and previous experience as well as their understanding and knowledge of investments and risks and their personality.

For all providers, the default lifestyle strategy is classed as a ‘balanced’ risk. This represents an average level of risk and if members feel that this does not match their attitude to risk there are alternative lifestyle strategies available that can offer more or less risk than the default.

The advantage of staying within a lifestyle strategy is that your investments will automatically de-risk as you approach retirement.

Self-Selecting Funds

If members do not wish to be in a pre-determined lifestyle strategy, they can self-select their own funds to invest in. The main disadvantage of this is that funds do not automatically de-risk as members approach retirement and therefore members who choose this approach must be willing to manage their own portfolio. This approach is only suitable for members with a good understanding of investments.

Retirement Age

Lifestyle strategies work by targeting your planned retirement age. Members should check that providers are aware of when they plan to retire. If they plan to retire later than the retirement age that the provider is aware of, the de-risking stage will commence earlier than it should and if they plan to retire earlier, de-risking will commence too late.

Therefore it is important to ensure that providers are informed of any changes to a member’s planned retirement age.

Sources:

https://www.aegon.co.uk/advisers/funds-for-workplace-pensions/aegon-workplace-default-fund.html

https://www.aviva.co.uk/adviser/documents/view/sp57390c.pdf

https://www.aviva.co.uk/adviser/documents/view/ex01242c.pdf

https://www80.landg.com/DocumentLibraryWeb/Document?reference=Q0042349_MultiAssetLifestyleProfile.pdf

https://www.royallondon.com/strategyfactsheets/strategyfactsheet.asp?InvestmentType=F&strategyid=348782

https://adviser.scottishwidows.co.uk/assets/literature/docs/45770IG.pdf

https://lib.standardlife.com/library/uk/invsum_s3ap.pdf

https://www.nestpensions.org.uk/schemeweb/nest/aboutnest/investment-approach/nest-retirement-date-funds.html

https://thepeoplespension.co.uk/help/knowledgebase/what-are-the-features-of-the-balanced-lifestyle-profile/

This document is for guidance only and should not be construed as advice. For advice in this area please speak to a professional financial adviser. Please see our pension administration services for more information.