The government’s drive to push ‘smaller’ trust-based defined contribution (DC) pension schemes into larger ones intensifies in the coming months. The DWP’s guidance is out – on the new ‘net return’ reporting kicking in from October as well as the new Value for Members (VfM) requirements applying from January 2022. The government’s clearly held view, based on data gathered on the governance and member outcomes surveys carried out in recent years, is that smaller schemes are struggling to devote the resources required to match the governance and member outcomes of larger schemes. The government and The Pensions Regulator see no reason why members of smaller schemes should be provided with less ‘value’ than members of larger schemes. So gone are the days of the Trustees’ Chair Statements comparing its scheme with schemes of a ‘like size’ and using the 0.75% charge cap as a yardstick for scheme charges. This is no longer sufficient and hasn’t really been fit for purpose for a while. Size, restricted resources and limited access to investment and administrative solutions should not be a reason for not offering a small scheme member everything a large scheme member enjoys. Benchmarks have shifted and trustees and employers are now required to keep pace with the biggest and best-resourced pension offerings.

Who is affected?

Trustees of schemes whether pure DC, or DC section in hybrid scheme, with combined assets of less than £100M now face a step-change in the way they must approach assessments of VfM and shouldn’t think that the previous assessments are suitable. Sponsoring employers of these schemes will be affected as these tests will force short-term cost, and long-term pension strategy decisions in many cases.

Does this mean all small schemes must transfer to larger schemes?

In our view – not in every case. The government’s mission is to improve standards of governance and through that – member outcomes. The ‘bigger is better’ mantra suits them in other ways as well as they are looking to pension schemes to finance large-scale, long-term economic development projects. Larger schemes are better able to support these aims. Trustees, however, have responsibilities to their members’ interests, and those interests may not always be aligned to the government’s agenda or to large pension scheme models. Evidence does suggest that there are many small schemes which have not kept up with the best in the last few years and time and money restrictions have hindered many trustee bodies. Undoubtedly, economies of scale should be exploited for the members’ benefit. It is thought possible for smaller, well-resourced, well-run and “close to their membership” trustee bodies to do a better job for their members than a remote larger one can. The direction of travel may be to transfer to Master Trust for many advisers – especially those with their own Master Trust solutions or related advisory revenues. However, providing they have the support of their employer and advisers, many smaller scheme trustees can continue to do the best job possible for their members. The new VfM requirements can, if addressed objectively and with forward-thinking, be the catalyst for stronger long-term trustee/employer partnerships which continue to deliver large scheme quality performance with small scheme member focus. This will however only be possible if the employer and trustee recognise the step-change in minimum standards and if the employer has the resolve to keep swimming against the inevitable, relentless tide of new regulatory requirements that will continue to come in future years.

What has to be done?

The regulations require trustees to compare costs, charges and net investment returns of their scheme, against those of three larger schemes. The trustees must then confirm whether their scheme matches or falls short of the chosen large scheme benchmarks with the results put into the publicly available Trustees Chairs Statement and on The Pension Regulator’s Scheme Return.

When do the new requirements apply from?

Trustees have to report the schemes net investment returns in Chair’s Statements for scheme years ending after 1 October 2021 and New VfM assessments, complete with large scheme comparator testing, will have to go into the Chair Statements for the scheme years ending after 31 December 2021. So, for a scheme with a year end 31 March 2022, a new VfM assessment will need to be done in respect of the year 1 April 2021 to 31 March 2022.

This will then be the new format for annual scheme testing and for future years Chair Statements. Chair Statements are of course a record of what the trustees have been doing in the previous scheme period so trustees should have decided what their course of action will be and should be confirming that in the Statement. The ‘what happens’ next decisions should have been made in order to get the Chair Statement completed.

How is the ‘large scheme VfM benchmark’ set?

Trustees need to look at the net returns and charges of three large schemes.

Interestingly the latest tweaks to the regulations have opened the door to consolidation slightly wider by requiring trustees compare their schemes VfM against a larger scheme with which they have ‘had discussions with’ on costs and terms. This is a slightly stronger push than the previous proposal – that the trustees would need to have ‘reason to believe’ one of the large scheme comparators would take the assets and members on board. Clearly, this means that trustees need to have agreed which types of large schemes they’d want to compare against and to have engaged with them to discuss terms.

The comparison as far as the regulations are concerned, needs to be based on the costs, charges and net investment returns. Comparisons should be based on the default investment strategy and most popular investment funds being used under the smaller scheme vs similar ones at the larger schemes. The trustees decide their own weighting system.

What happens if the scheme doesn’t match a large scheme VfM?

A failure to match a large scheme VfM benchmark means the trustees will be expected to start the process of transferring to a large scheme and wind up or to explain how the shortfall is being addressed and how the scheme is being upgraded to match large scheme standards.

Choosing which schemes to compare with?

That’s up to the trustees. The government has decided not to create a model scheme for comparison. Instead, they expect trustees to choose the schemes they wish to compare against.

Even if the first instinct is to avoid consolidation, choosing a large scheme which feels like a good fit for your members makes sense. Failing a VfM test against a large scheme which you wouldn’t feel comfortable transferring your members too, seems like a pointless own goal.

So VfM comparators might as well be providers you’d feel comfortable transferring to – if it comes to that. The guidance instructs trustees to look at occupational schemes, and Master Trusts have been touted as the favourites but it also specifically mentions personal pension schemes as an alternative.

Master Trusts have reduced in number and received the regulatory rubber stamp under a new authorisation regime in recent years – catching up with personal pension providers which have been authorised by the Financial Conduct Authority for many years. There have however been a number of consolidations in the Master Trust market already and there’s expectation that will continue. This could generate some turbulence for members in some Master Trusts as administration, investment platform and governance models may be harmonised. It’s interesting to note in the 2021 Corporate Adviser Survey of Master Trust GPP Defaults Report of April this year, that when NEST and Peoples Pension are taken out, the six biggest, well established Group Personal Pension Plan providers had combined assets of more than the other 24 surveyed Master Trusts put together. Group Personal Pension Plans still have the power to exert economies of scale in ways many of the Master Trusts haven’t yet managed. The governance model is different but why would trustees ignore this sizeable section of the market?

Also take into account any other schemes which the employer may be running alongside the trust based scheme, for example as a default auto-enrolment vehicle. If they qualify as large scheme alternatives there may be some advantages for considering them for comparison.

How do we create our VfM template?

Our view is that it should be as member specific as possible – the template, your template- should be based on your scheme and the knowledge you have of your members. Recognise the different legacies and current circumstances your members have, for example, ex-defined benefit? Investment guarantees? Consider the demographics, current investment strategies, pot sizes and proximity to retirement and likely retirement choices. Identify what your members value most. Create your own ‘member specific VfM’ as the template to hone in on the attributes a large scheme alternative should have, and also to identify the areas you need to address if you want to maintain your existing scheme. The VfM test as prescribed only requires comparisons to be made on the costs, charges and net returns, but clearly the value for these, and the outcomes your members receive by the time they take their benefits, depends on what they are getting for these costs.

Account for communication preferences and access to member decision-making support at critical times on their journey, combine these scheme design factors and weight them according to your membership characteristics to create your member-specific VfM template. Then you have a basis for shortlisting suitable large provider comparators.

Beware of standard templates which may just be ticking other people’s boxes.

What sort of large scheme terms should we expect to see?

That depends on the size and nature of your current scheme. Some larger providers offer fixed ‘off the shelf’ terms which generally come with fixed ‘off the shelf’ pension products. Many large scheme providers will offer specific terms based on your membership demographics, future contribution streams and of course assets. The typical member a large scheme already has in its existing client bank can also be important. Master Trust bodies, and Independent Governance Committees managing group personal pensions, will design their schemes for their typical member profile and if that differs from your members – then future interests and scheme designs may not be aligned. Trustees have a duty to seek out the best terms and package they can find for their members so if they are genuinely testing the value of their scheme they should look at this as a dry run for a possible suitor.

What does a large scheme VfM benchmark look like?

Terms and the packages of services provided, do vary from provider to provider. Generally though, a small scheme is likely fall short of a large scheme VfM benchmark if it doesn’t provide 24/7 online member access, integrated drawdown options, full administration and reporting services, and diversified investment strategies at less than a 0.5% per annum member fund charge. Charges could easily be lower if there are ongoing contributions, average fund sizes are good and the employer is directly paying for any of the expenses. The 0.75% Charge Cap often quoted in Chairs Statements is not a credible benchmark and hasn’t really been for a few years. Large scheme offerings will also come with a range of calculators and tools for members. Investment options come with high levels of governance and monitoring including self-select funds as well as default options. The degree of reporting to employer governance committees, to enable ongoing monitoring of employee outcomes also varies.

Governance and administration metrics

Much of the new VfM test focus will be on the comparative net returns and charges. These will however be snapshots in time. We all know how misleading they can be and how short lived previous patterns of performance can be. The ongoing governance and administration model is critical. The 2021 regulations reiterate and amend the requirements under the seven key metrics for governance and administration within the overall VfM test but they don’t require comparison between different governance models. This is understandable because a full review of three different large schemes’ governance frameworks could be onerous. However, there are good reasons to consider the governance offerings if only on a high-level basis. Governance is one important element of the charges being compared against and it also enables the smaller scheme to compare what it does and how it might improve in some areas. Many smaller schemes increasingly benefit from having a professional independent trustee to help maintain a robust governance framework. If a VfM test is failed and continuing the scheme is still the preference it is possible increased attention to governance will be required and an independent trustee could be part of the solution.

Defining your future governance model – whether continuing or consolidating

Large scheme governance models are being seen as the drivers of better member outcomes. If a transfer to a new larger arrangement is a possibility, the governance of that new arrangement should be considered. Experience shows us that no Master Trust or GPP provider can guarantee to continually protect against substandard outcomes in the long or short term. Indeed, even some of the largest Master Trusts have had challenges in recent years and the 2021 Corporate Adviser survey exposes the range of outcomes experienced by different large scheme members. From a trustee perspective you need to discharge your liabilities safely and be confident your members’ interests will be looked after, for years to come. From an employer perspective you may have existing and future employees going into the chosen scheme so, reputationally and from an employee value perspective you would want any future governance model to be strong. So wouldn’t both parties want to ensure they have the frameworks for monitoring and reviewing members’ outcomes post-consolidation? Group Personal Pension providers are well versed in providing the Management Information (MI) to enable governance committees to monitor provider performance generally. Some Master Trusts are able to provide scheme and members specific MI while others are less forthcoming. So, if you are thinking ahead and looking at possible consolidation options it’s worth looking beyond the basic net returns and charges comparison and considering what ongoing governance you would want to maintain. Much of the governance can be outsourced and managed by large scheme providers but it’s worth checking on the governance support provided by these when you are choosing your comparators.

How long have we got? Really?

The new regulations came into force on 1 October 2021 and kick in for scheme years ending after 31 December 2021. The reality is though that VfM tests in future Chairs Statements will be based on the VfM your small scheme is offering right now and trustees are expected to have concluded what the position is and if any actions are being taken, when the Statement is submitted. Also, although VFM testing is a trustee responsibility, the employer plays a key part in what happens next. The costs of continuance or consolidation are best identified well in advance for employers to plan for and the employer will likely have a view on what it is and is not willing to support in terms of future pension provision. The new VfM test could be a game-changer for the way the employer sees the scheme’s future. Planning and implementing alternative pension strategies can be done in weeks and months but often runs into years so preparing the ground now makes sense.

So who do we need to be talking to? What do we need to be doing now?

We’d suggest trustees should be acting on this now and agreeing processes and advice needs with your sponsoring employer. We’d suggest trustees should be standing back from previous years’ VfM advice and checking they are clear on the potential vested interest conflicts which could exist. Not only to make sure they are getting a complete and unbiased picture of the alternatives, but also that the new VfM process gives a balanced view on the pros and cons of continuance or consolidation. Speaking to different advisers with good knowledge of the whole pension market, contract based as well as own trust and Master Trust will help you demonstrate a thorough process. It will also help demonstrate how members’ future interests are being adequately considered.

We’d suggest employers need to be actively engaged in this right now. If it’s not been raised so far by the trustee body employers should be finding out how the trustees plan to carry out the VfM tests. In an ideal world, employers should know now, what the most likely outcomes are because continuance or consolidation are likely to bring additional costs and a change in the pension strategy. Again, speaking to an adviser about the possible outcomes makes sense and will help them prepare for possible change next year.

What do Broadstone do?

At Broadstone, we have no large scheme conflicts – no Master Trust or personal pension scheme products of our own offering and we advise on all sides of the pensions market from group personal pensions to SIPPs, own trust arrangements and Master Trusts. Generally, our experience is that members’ outcomes are best served by helping employers and trustees work together recognising the different responsibilities and objectives of each party. To us, this approach is critical in helping trustees and employers address the new VfM requirements.

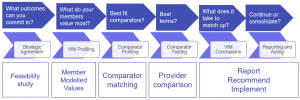

Our approach is to:

- Recognise the impact of the requirements on the trustees, employer and members

- Revisit the pension strategy – it may not change much but new VfM tests mean it should be challenged

- Reset the long-term plan – likely it will be necessary whatever the initial assessment as annual VfM testing means new commitments to matching large scheme benchmarks year after year

Our method is to:

- Understand objectives and constraints – employer and trustee

- Define with you, your scheme and member specific VfM profile

- Map to large scheme offerings and run scheme-specific VfM tests

- Encourage employer and trustee collaboration from the start

We’d start with a feasibility study to assess the most likely outcomes of the new VfM tests with potential costs and benefits of options available to employers and trustees. A joint workshop would help trustees and employer agree the levels of commitment required from each. This may shortcut to agreement on the preferred solution i.e. an action plan for consolidation or targeted programmes of ongoing improvement if required for a strategy of continuance.

Whether you are an employer just wanting to get to grips of the potential impacts on you and your employees or a trustee wanting to discuss how your scheme might fair speak to us for a whole of market opinion and an objective end-to-end roadmap.