As a HR manager, or business leader, you may already have numerous programs in place that look after your employee’s physical wellbeing – subsidised gym membership or a cycle to work scheme for example. You may also look after their emotional health via stress awareness training or flexible working. However, financial wellbeing is often overlooked as an employee benefit and yet when people have money worries, this can impact on both their physical and emotional health and as a result, their productivity could suffer.

What is financial wellbeing?

Financial wellbeing is all about your employees feeling secure in their financial situation and having the means to support their needs and live an enjoyable life. If employees are capable of making financial decisions it doesn’t necessarily mean they have the capacity to save and invest in their best interests.

Money worries can have a significant impact on an individual’s mental wellbeing and it is our view that financial wellbeing could, and should, become an important deliverable to a company’s overall wellbeing offering. This issue is not simply about pay, it is about living well, saving for the future, having enough money for emergencies and avoiding getting into (further) debt.

How money worries may impact your workforce?

There have been numerous studies and reports that show how financial worries can have a negative impact on engagement, productivity and absenteeism at work.

A survey of over 10,000 employees found that employees with money worries are more likely to have sleepless nights, not finish their daily tasks and to have troubled relationships with colleagues. They are also more likely to be looking for a new job. Further research also suggests that one in four employees have financial concerns that have affected their ability to do their job, one in ten say they have found it hard to concentrate/make decisions at work and 19% have lost sleep worrying about money.

How your business can help employees take control of their finances

Breaking the taboo – time to talk about the ‘M-word’

A great place to start is to actually talk about money. While some people are happy to discuss how much they have in their bank account to anyone who asks, many others consider discussing money as a private matter and often feel vulnerable admitting they are facing challenging times. Moving of our mindsets to discuss finances more openly is a good starting point especially in a change of circumstance such as retirement, new additions to the family, first property purchase or if they are in any sort of debt.

A challenge in doing this is that employees are not always comfortable discussing their financial situation with colleagues, HR or line management, which is why financial wellbeing may be better received if it is outsourced as part of an employee benefits package, rather than trying to tackle it in-house.

The importance of budgeting

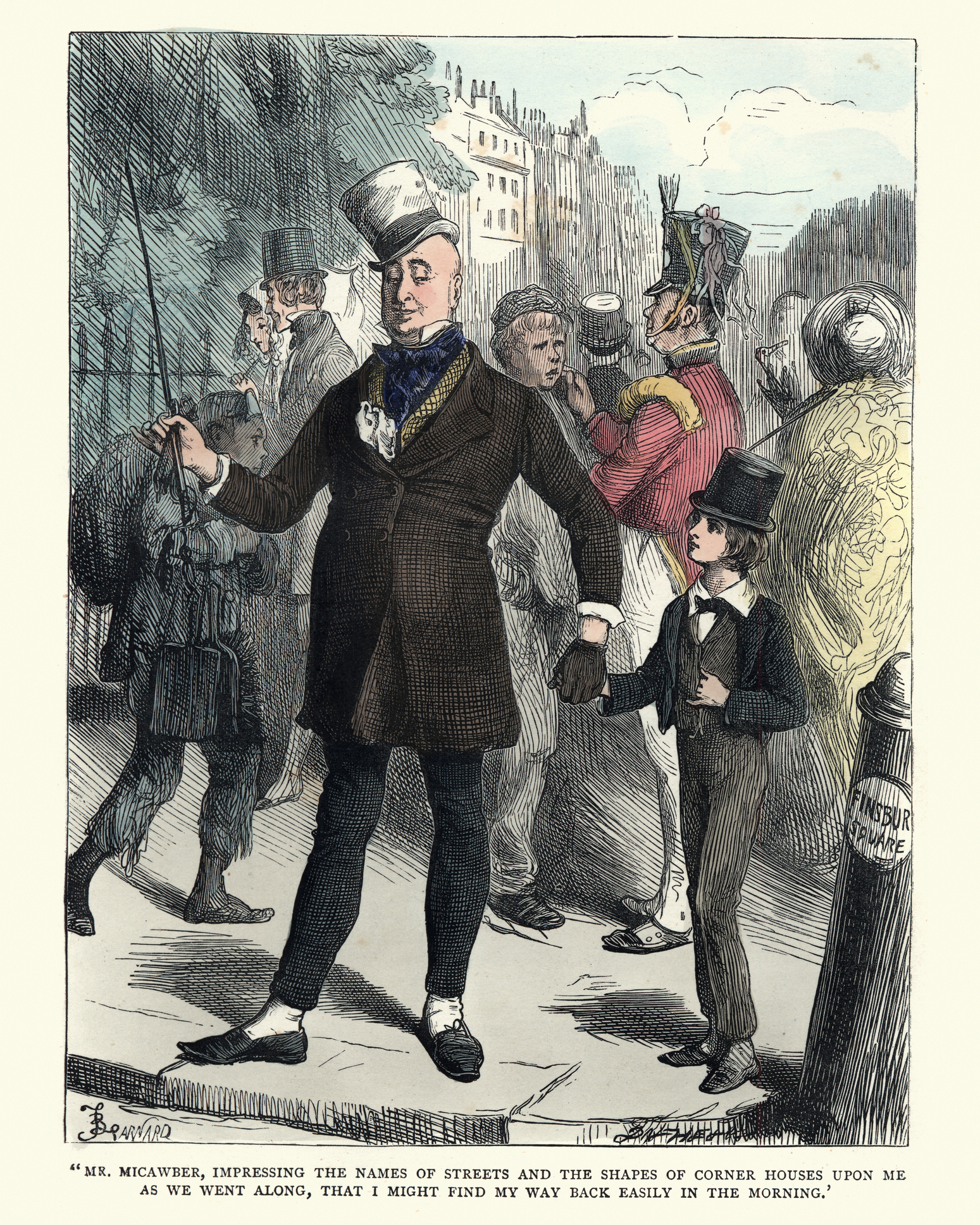

“Annual income twenty pounds, annual expenditure nineteen pounds, nineteen shillings and sixpence, result happiness. Annual income twenty pounds, annual expenditure twenty pounds ought and six, result misery”. Mr Micawber from Charles Dickens’ David Copperfield.

Mr Micawber’s message is quite simple – if you live within your means you will be happy. If, however, you spend more than you have, you will be miserable. However, easier said than done, but if your employees understand how to budget effectively, it can make a huge difference to their spending habits.

‘Everyone is better off!’

Social comparisons can have a negative impact on people’s mental wellbeing in general, particularly so in the social media generation we live in today, and when it comes to finances this is no different. Morning Star believes that “people have a tendency to compare themselves with those who are better off, and this was strongly associated with negative financial emotions. In other words, most of us seem to be actively making ourselves feel bad about our own financial circumstances by always looking up to those who have more.”

It often seems that everyone else is better off – the nice car, the big house, the expensive holidays, but comparing what your colleagues appear to have can cause feelings of inadequacy. But that nice car could be leased, the mortgage repayments on the big house could be behind and the expensive holidays could be paid for via credit card. The colleague you envy could be in considerable debt.

How can you implement an effective financial wellbeing solution?

There are numerous way you can help employees take control of their money and improve their financial wellbeing. You can signpost employees to all the free sources of information that can assist them – the Money Advice Service, for example, or a local credit union, debt charity or even your bank. Many organisations like this will be happy to come and talk to employees and provide access to their literature and publications.

If you think that a more tailored solution will deliver those better results then please talk to an expert here at Broadstone about how a well structured, transparent and non-invasive financial wellbeing strategy can enhance your overall employee benefits offering. This could include group learning or one to one financial coaching where employees can understand all the options within their control in clear and straightforward language.

You may find that an existing benefit provider can offer a financial wellbeing programme, or, it may prove more sensible to introduce a new one entirely. There is no one size fits all solution and there are often so many options available to us that are not being used to their full extent (if at all).

Whatever you decide, Broadstone is with you every step of the way and we are happy to have an informal discussion about which route is best for your employees and your overarching wellbeing solution.