Introduction

Broadstone have been working with a tech company, based in London, for 2 years. In this time they had seen exponential growth from 150 to over 800 employees. With the origins of the business lying in the U.S. they were initially keen on a range of health benefits which they had a good working knowledge of. However, in practice they required much more advice on pensions, in particular auto enrolment and pension’s legislation.

Broadstone identified a challenge that the client would face in that there were more than 80 employees earning over £100k pa, with 40 of them earning over £150k pa, 15 over £200k pa and 4 over £300k pa.

In the summer of 2015, the government announced in the Budget, their intention to introduce regulations to curb the tax relief on pension contributions enjoyed by ‘high earners’. The tapered annual allowance was introduced from 6 April 2016, imposing a reduction in their tax-relievable maximum pension contribution when two separate defined earnings thresholds were exceeded.

A communication strategy on how to reach out to the high earners and offer a solution became a priority. Although individual tax affairs are not the employers’ responsibility, often high earning staff are highly valued individuals, key to an organisation – ensuring that they aren’t hit with unexpected tax bills as a result of something that has been provided to them as an employee benefit helps to preserve good employee/employer relations. Especially when the benefit is designed to improve financial wellbeing, as is the case with a pension!

Significance

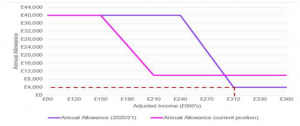

The graph below illustrates the Tapered Annual Allowance for the 2020/2021 tax year, with Threshold Income £200,000 and Adjusted Income £240,000:

As you can see, a high earner could potentially have their annual allowance reduced from £40,000 to just £4,000 (from all sources, including employer contributions and tax relief as well as an employee’s own contributions). If an individual makes pension contributions exceeding their annual allowance (assuming they have no annual allowance carry forward available), they will be faced with an annual allowance charge which will be added to the individuals taxable income.

Objective

The task of communicating a complex pension issue to a young tech business had a number of challenges. The high earners were relatively young for their earnings; a number were originally from overseas; based in numerous locations around London and all were very busy individuals. The objective of communicating a complex message therefore became slightly more complicated.

Solution – 3 stage project

Stage 1 – video content (identify the problem)

- The Broadstone consultant recommended that short, sharp video content was the best way to engage with this time-poor group of employees, where scheduling face to face group presentations and coordinating diaries would have proved a very difficult feat.

- Broadstone edited a short animated video (mobile compatible) lasting less than 5 minutes.

- The video covered the Tapered Annual Allowance and related topics such as: Lifetime Allowance, Carry Forward, Money Purchase Annual Allowance, Tax Relief and Personal Allowance.

- HR distributed the video, asking for confirmation that this had been received and strongly suggested that they watch the video as they could be affected.

- At the end of the video, staff were advised that they were eligible for a guidance meeting with Broadstone, paid for by their employer, to establish if they could be affected by the issues discussed in the video.

Stage 2 – guidance meeting (understand the impact of the problem)

- Once HR had provided Broadstone with the names of the individuals who wanted a meeting, Broadstone issued a pre-meeting fact find to establish the individual’s additional pensions and any income outside of their employment.

- The information in the fact find was most important as this helped the consultant understand the needs of the individual and make suggested next steps.

Stage 3 – referral for Personal Financial Planning (plan effectively to resolve the problem)

- If it was established that the individual needed financial advice relating to any of the matters concerned, it would be suggested that they contact their own financial adviser (if they have one) or refer them to Broadstone’s Personal Financial Planning team to speak to a professional adviser.

- The Personal Financial Planning team or their own adviser would now be in a position to understand their needs and advise accordingly.

- The costs of the financial advice would be met by the individual, with all fees disclosed in advance before any work commenced.

- The employer holds the discretion if they wish to contribute towards this cost for some or all employees, and some of the costs could be facilitated by the use of salary exchange (up to £500).

Outcome

By using the video content distributed through the HR team internally, the client was able to reach the workforce intended, communicating a complex pension issue that in turn allowed the staff to make a decision on whether they would like a guidance meeting.

All individuals, whether they required personal advice or not, achieved a positive outcome and gained an improved understanding of their retirement planning.