Welcome to the latest edition of the Broadstone Sirius Index, our tracker monitoring the performance of our average schemes as they navigate their way to their low dependency funding target.

Funding to end of January 2023

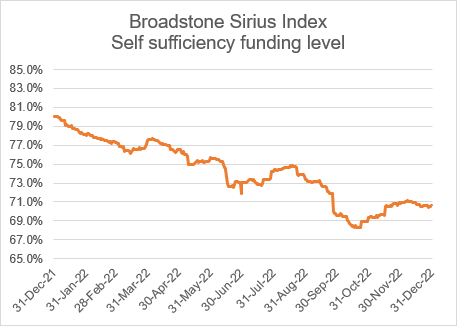

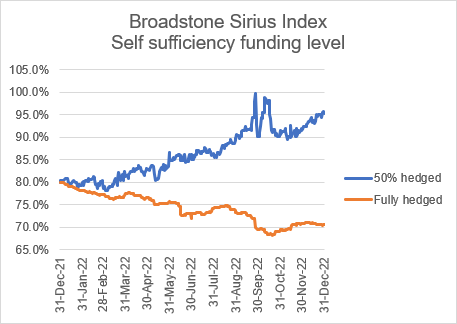

The BSI started 2022 at 80% and has reduced to 72% at the end of January 2023. The continued market stability through January saw both the hedged and 50% hedged schemes make small improvements in funding levels and reduce deficits.

It comes following significant volatility at the end of last year. Fully hedged schemes saw a 9 percentage point drop through the year so January marks a positive recovery, while half-hedged schemes performed well in 2022.

Breaking scheme funding down into assets and liabilities it is clear to see that liability reductions have far outpaced falls in asset values.

For example, the 50% hedged scheme which had £40m of assets at January 2021 has seen that value drop to £30m as at February 2023. However, the £50m of liabilities have outpaced this decline reducing to £31m over the same period resulting in the dramatically smaller deficits than we’ve previously seen.

The Hedged and unhedged story

The stability we’ve seen over the past three months has meant that our hedged and unhedged schemes have had a similar experience. Both schemes improved their funding levels and reduced deficits. Like most of 2022, the impact of a slight rise in interest rates and lower inflationary expectations has impacted the assets less for the 50% hedged scheme generating a larger funding improvement for this scheme over the last two months.

Our hedged scheme’s funding position has, therefore, seen an improvement in funding to the end of January at 72% and our scheme with only 50% of liabilities hedged at 96%. These both started 2022 at 80% funded. Crucially though, both schemes have reduced their deficits as assets, liabilities and therefore the deficit end the year much smaller than they started it.

Low dependency and the Funding Code consultation

The outlook for the UK economy remains unclear. The interest rate rise in early February shows that the Bank of England is still concerned about the impact and pace of inflation as well as the UK’s recovery from the shocks of 2022.

This rate rise was expected and long-dated gilt yields appear to be falling ever so slightly. We will continue to monitor this and report with future versions of the Broadstone Sirius Index.

The release of the Pensions Regulator’s Funding Code reiterated the importance of our low dependency measure of funding as the long-term target for Trustees as they manage down the risk in their defined benefit scheme. We are working on further enhancements to the Index to ensure it matches TPR’s expectations and helps our clients set the appropriate strategies for their funding journey.

You can download the BSI here.