- New Index monitors real client data to show how schemes are progressing on path to ‘self-sufficiency’

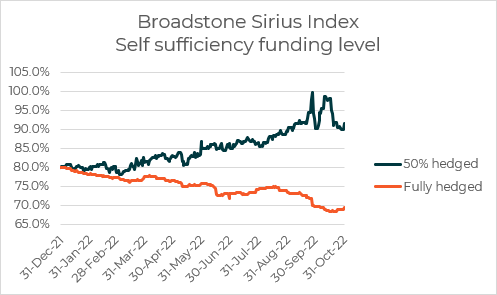

- Inaugural BSI reveals funding for a scheme with a fully hedged strategy would have fallen to 69% from 80% between January and October 2022

- Half-hedged schemes would have improved funding to 91% over the same period

The Pensions Regulator and UK Government are on a path to lock down defined benefit schemes into a low dependent state. This means reaching a position where assets and liabilities are matched and the investment strategy is low risk with future reliance on the employer not anticipated.

To help trustees and employers alike contextualise the funding position on a low dependent state, Broadstone – a leading independent pensions consultancy – is pleased to announce the launch of the Sirius Index. The Index will track the progression of pension schemes to low-dependent or ‘self-sufficient’ status.

By mapping the movement towards this position across its wide book of clients, covering all areas of the market, Broadstone will provide novel and informed insight for the discussion on the success or otherwise of various strategies to achieve the low dependence position.

To do this in a way that may be more relatable to trustees and employers the BSI creates a number of sample schemes that are adopting alternate strategies and monitors their journeys to self-sufficiency, publishing findings on a monthly basis.

For our inaugural release, we have looked at the year to 31 October 2022 which represents an unprecedented year for the movement of long-term interest rates and this has thrown out some surprising results.

BSI shows that while the present values of liabilities have reduced, the loss of value in hedged strategies plus the underperformance of assets over the year has reduced the funding ratio from 80% at the beginning of the year to a much lower 69% as at 31 October.

For lesser hedged schemes, for example one that has hedged 50% of their liabilities, they may have had a bumpier ride over the year so far but as assets fell less than liabilities their position will have improved to 91% (from the same 80% funded starting point).

Read the inaugural Broadstone Sirius Index here.

Nigel Jones Head of Consulting & Actuarial commented “We are pleased to launch the Broadstone Sirius Index (BSI) which brings a unique perspective on the benefits of hedging or otherwise in the journey schemes are on to reduce risk and reach low dependency. Low dependency is an important goal that allows trustees and employers to push on towards buy-out and benefit security for all their members. Our evidence base is already highlighting the different experiences of varying strategies and the decisions trustees make at this point will be crucial to their path over the next 5 years and beyond.

We look forward to future releases of our monthly tracker and are sure it will be a useful part of the discussion”.

Media contacts

Temple Bar Advisory

Alex Child-Villiers / Will Barker / Sam Livingstone

broadstone@templebaradvisory.com / 020 7183 1190

About Broadstone

Broadstone is a leading UK consultancy that specialises in advising employers and pension trustees to secure the prosperity of their employees and scheme members.

Across the Group, Broadstone delivers a range of independent services from pensions administration, consulting, investments and employee benefits solutions to small businesses, large corporates and pension scheme trustees.

Broadstone empowers its clients and colleagues to navigate complexity and change confidently with clarity, leadership and purpose and delivers this on a platform of exceptional service and robust stability.

The team is made up of over 500 expert consultants and administrators across seven offices through the UK.